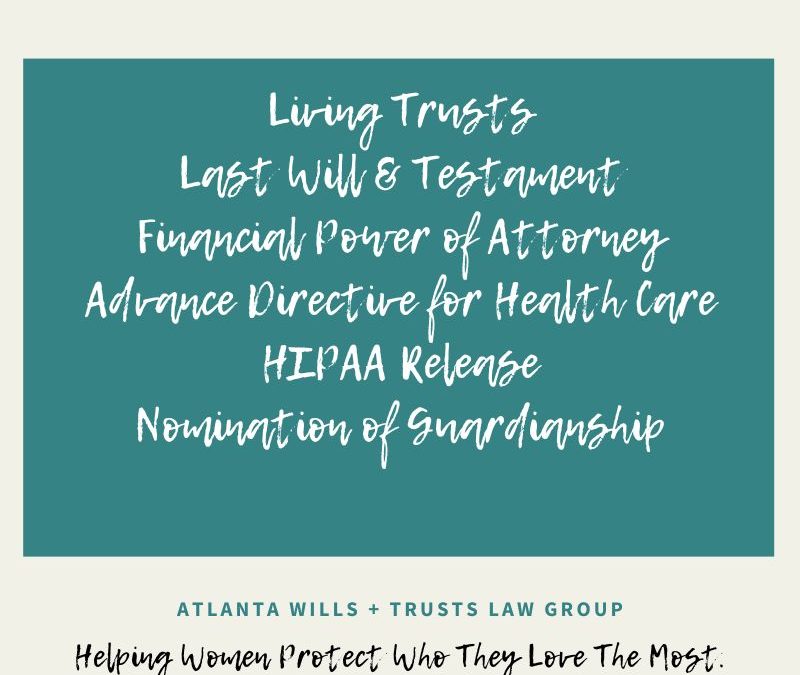

The Documents In Your Estate Plan!

First, I want to tell you what is an “estate”? Your “estate,” for purposes of our conversation, is made up of what is in your name when you die. Your “estate” owns all of it the second after your die (figuratively speaking). Then your “estate” wants to give it away based on what you want in your documents or other means. We will focus only on what is in your documents. The documents in your estate plan!

What does each document in your estate plan do?

Last Will & Testament

If you have a trust, you should still have a Will. It is a different type of Will called a “pourover will.” A pourover will is a safety net UNDER your revocable living trust. The Will catches anything not in your Trust. Your Will basically directs whatever wasn’t put in your trust to get put into your trust after you die. If you need to “pour” something into your last will and testament, it does mean that you will have to go through probate.

If you DO NOT have a trust, then your Last Will and Testament is the main document in your plan after you die. When you die, as mentioned above, everything you own is instantly now owned by your “estate”. Your Executor will take your Will to the Court and ask the Court permission to distribute everything in your estate according to your wishes in your Will. Once this happens, your estate closes.

Key points: Your Will is only effective/valid the moment you die. If you have nothing in your “estate”, your Will may not be needed. Your Will does NOT change or override beneficiary designations or if you own something jointly with a spouse.

Revocable Living Trust

A trust is like a beautiful wooden box where you keep things safe. Safe for you and safe for those you wish to have your estate after you pass away. So after you build your trust with an attorney, you need to put things inside the box. This is called trust funding. Your trust helps you while you are alive and it helps carry out your wishes after you pass away. It also, if done properly, allows your estate to avoid probate court!

During your lifetime, your Living Trust helps you if you are incapacitated. You cannot manage your money, so your backup Trustee does it for you in the Trust.

After you die, your Living Trust works in conjunction with your Last Will & Testament if there are assets that didn’t get put in your box. The Will will “pour” whatever may (or may not) be in your estate into your Trust. The Trust will distribute all of your property as you have directed.

Key points: Your Living Trust is effective during your lifetime and after you die. It should be the main document controlling what you own (property and money) during your lifetime and after you die. It can outlive you for however long you want, holding onto money for someone else’s behalf.

Power of Attorney (Finances)

Durable Financial Power of Attorney allows a person (Agent) you have designated to assist you and/or make financial decisions for you as if they were you. This is a very powerful document as it impacts your financial well-being during your life.

Key points: This document is effective only during your lifetime. It stops working completely when you pass, and your Agent can no longer act for you.

Advance Directive for Health Care

This document allows the person you have designated to assist you and/or to make healthcare decisions for you as if they were you. There are three parts to this document: 1. Who is your Agent 2. What guidance do you want them to have if you are at the end of your life (as determined by medical doctors) and 3. How do you wish for your remains to be treated.

Key points: This document is effective only during your lifetime. It stops working completely when you pass away, and your Agent can no longer act for you with the exception of how your remains are treated.

HIPAA Release

HIPAA Release is a document which compliments the Healthcare Power of Attorney and Financial Power of Attorney. It is a replica of many portions of the Federal and State statutes relating to protected healthcare information. This allows the individuals you name to access information, but not necessarily be the decisionmaker.

Key points: This document is effective only during your lifetime.

Nomination Of Guardianship for Minor Children

There are 3 types of guardians we will ask you to name: Emergency, Temporary and Permanent. A guardian cares for your children’s person (not their money you leave them). Such as their education, medical decisions, clothing, shelter, etc.

Emergency guardians typically are geographically close by and can be at your home very quickly if something happens. They do not have to family, although many do name family who live nearby.

Temporary guardians will be there during a short duration until you recover, return, or are no longer incapacitated. Usually, the person named is also the person who is the Permanent guardian.

Permanent guardians are those persons you nominate who will permanently care for your children because you cannot due to death or permanent incapacity.

The court will have to approve your nomination. This is unavoidable. Your nominated person will need to know they are nominated and will need to know that they will likely have to petition the court to be officially appointed as a guardian.

Do you have all of these documents in place? If not, we’d love to help you!